Comparing the US Dollar Index to Other Major Currencies

Comparing the US Dollar Index

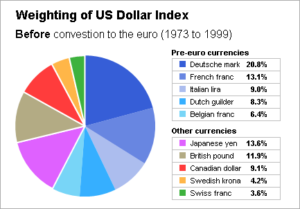

The US Dollar Index is an important gauge of the strength of the United States dollar against a basket of other major currencies. It was created in 1973, but is still useful to this day for traders and investors who want to track currency values around the world.

The ดัชนีดอลลาร์ สหรัฐ is an index of the value of the US Dollar against a basket of six other major currencies, including the Euro, Yen, British Pound, Canadian Dollar, Swedish Korner, and Swiss Franc. The index rises when the dollar is strong against these currencies, and falls when the dollar weakens against these currencies.

It is a measure of the value of the dollar against a weighted basket of currencies used by the US trading partners and a subset of advanced foreign economies and emerging market economies–using weights based on trade in goods. The US Dollar Index is a popular tool for measuring the health of the dollar in global markets and can be traded on the Intercontinental Exchange (ICE) as futures, ETFs, CFDs or options.

Comparing the US Dollar Index to Other Major Currencies

In 1998, the Federal Reserve created a trade-weighted Dollar Index to make it more relevant to the economic situation in the United States. This new Index combines the original US Dollar Index with currencies of some emerging market economies, such as Brazil and China, and also includes the European Union’s euro.

This makes the new index more relevant to the economy in the United States and it is also a better measure of the US Dollar’s performance. This means that it is more likely to be a leading indicator of the value of the dollar than the older US Dollar Index, and it is less expensive for investors.

One of the biggest shortcomings of the US Dollar Index is that it only measures the strength of the U.S. Dollar against a small group of other major currencies, leaving out some of the most important currency pairs. For example, the Chinese yuan and the Mexican peso are not included in the index, but are among the most significant trading partners of the United States.

Moreover, it uses a geometric mean in its calculation, which means that the price of the dollar will tend to be lower than other currencies. It also means that the impact of the euro on the Dollar Index is larger than other currencies, even though this may not always be the case.

Although the US Dollar Index is an important tool for assessing the currency’s value, it should be compared to other major currencies in order to get a more accurate picture of how strong the US Dollar is against those currencies. Many of the currencies in the index have had their values fall over the past several years, but the United States Dollar has remained relatively stable.

The US Dollar Index has been a safe haven for global investors since the 1970s, but it is susceptible to a variety of factors that affect its value. These factors include monetary policies, inflation, economic growth, credit ratings and market sentiment.